- XRPL meme coins mirror XRP’s price due to AMM liquidity pools maintaining parity.

- External factors like whale activity and sentiment can drive independent meme coin moves.

- AMMs offer stability but don’t eliminate risks from sell-offs or broader market shifts.

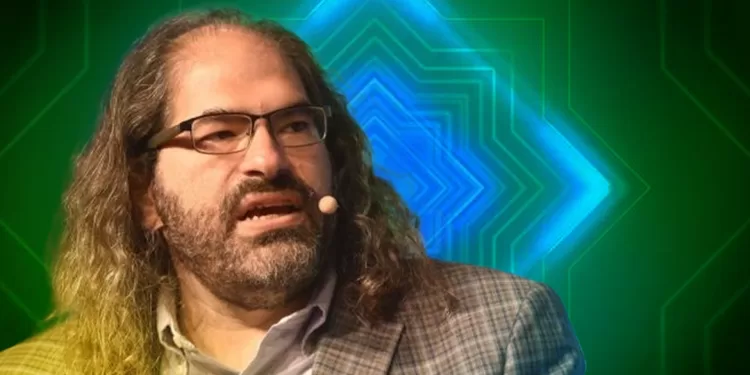

Ripple’s CTO, David Schwartz, has highlighted how many meme coins on the XRP Ledger (XRPL) move in sync with XRP’s price changes. Unlike other ecosystems where meme coins fluctuate based on hype and speculation, XRPL-based meme coins often mirror XRP’s movements due to their reliance on automated market maker (AMM) liquidity pools.

These pools maintain a constant exchange rate between XRP and the meme coin, ensuring price stability relative to XRP. This mechanism introduces both risks and opportunities for investors looking to trade these assets.

I noticed something interesting about many memecoins on XRPL. In many cases, nearly all of their liquidity is in the form of an AMM between XRP and the memecoin. This means that if the price of XRP (say, measured in dollars) goes up, say, 5%, the price of the memecoin (again,…

— David "JoelKatz" Schwartz (@JoelKatz) March 3, 2025

How AMMs Influence XRPL Meme Coins

AMMs play a crucial role in determining the liquidity and price movement of meme coins on XRPL. Many of these tokens derive nearly all their liquidity from AMM pools paired with XRP.

Consequently, any increase in XRP’s value leads to a proportional rise in the meme coin’s price. For instance, if XRP’s price jumps by 5% against the US dollar, the meme coin tied to it through an AMM will also increase by 5%, assuming no other market influences are at play.

However, while XRP’s price movement directly impacts these tokens, meme coins can still move independently due to market-specific events. Whale activity, community sentiment, or sudden news can cause meme coins to surge or decline outside of XRP’s performance. This dual exposure means traders must navigate both the broader XRP market and token-specific developments.

Double-Edged Nature of Liquidity Ties

Meme coin investors on XRPL should recognize that their holdings are indirectly linked to XRP’s price action. If XRP rises, meme coins benefit automatically, potentially leading to profit-taking by investors seeking to cash in on gains. On the other hand, if XRP drops, meme coins tethered to its liquidity pools will also face an immediate decline in value.

Moreover, the presence of AMMs reduces extreme volatility commonly associated with meme coins in other ecosystems. This structure provides some stability but does not eliminate risks. Large sell-offs, external market events, and shifts in investor sentiment can still cause significant fluctuations.