- BTC dipped 1% while ETH rose 3.6%, signaling diverging momentum between the top two cryptocurrencies.

- The asset giant added 4,420 BTC and nearly 20,000 ETH to its ETFs, showing growing institutional confidence.

- TON, ENS and UNI saw the most gains, while MXC jumped more than 150%, showing that there was speculative activity behind these gains.

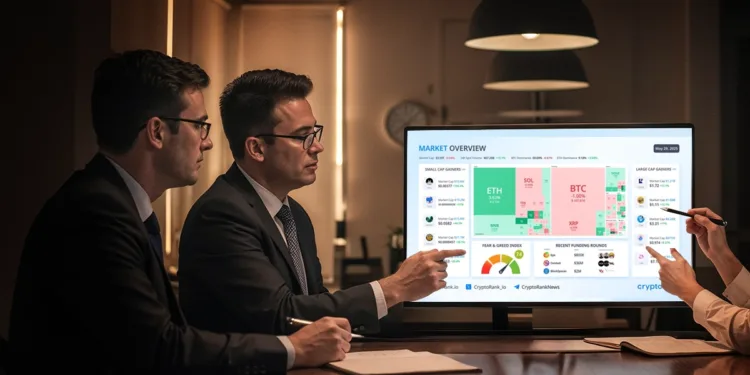

The global cryptocurrency market opened the week with a mixed signal, as Bitcoin slipped while Ethereum and select altcoins recorded significant gains. Bitcoin (BTC) was down by 1.00% over the past 24 hours, trading around $108,000. Cork Protocol reportedly lost $12 million in wrapped stETH following an exploit. In contrast, Ethereum (ETH) displayed relative strength, climbing 3.62% to reach approximately $2,733. The broader market capitalization stood at $3.59 trillion, signaling continued resilience despite isolated pullbacks.

According to data from CryptoRank, the Fear & Greed Index currently sits at 74, placing the market in “greed” territory. This sentiment reading suggests that traders remain optimistic but may be exposed to higher volatility and risk. Additionally, 24-hour liquidations amounted to $291.94 million, indicating aggressive positioning across leveraged markets as participants reacted to price swings and headline-driven developments.

Altcoins Rally: TON, ENS, and UNI Lead with Strong Weekly Gains

Top-performing altcoins such as Toncoin (TON), Ethereum Name Service (ENS), and Uniswap (UNI) are all showing strong upward momentum. TON was up 8.0% currently trading at $3.33 with ENS at $24.88 with 7.1% increase.

Uniswap (UNI) rose 3.9% over the past 24 hours, reaching $7.12. Its steady 3.9% gain over the week points to continued upward momentum. With a circulating supply of 628.68 million tokens, UNI now holds a market cap of $4.47 billion.

BlackRock Boosts ETF with Major BTC and ETH Additions

BlackRock went large in the digital asset space by acquiring 4,420 Bitcoin (BTC) and 19,810 Ethereum (ETH) for its spot exchange-traded fund (ETF) holdings. The acquisition mirrors continued institutional interest for major cryptocurrencies, particularly as regulatory clarity on ETFs grows in the United States.

With this large purchase of BTC, BlackRock is increasing its exposure to cryptocurrencies through registered investment products. Furthermore, adding nearly 20,000 ETH represents one of the largest Ethereum purchases by the company to date. It means that BlackRock believes Bitcoin and Ethereum will play a key role in the growing digital economy.

Small-Cap Tokens Rally with High Volatility

Smaller-cap assets experienced heightened volatility, with several coins seeing double- or triple-digit percentage gains. Moonchain (MXC) surged 158.4%, leading the pack. Other major gainers included Vita Inu (VINU)+51%, Mamo (MAMO)+44.3%, Beer2 (BEER2)+36.1%, and Ancient8 (A8)+26.4%, all showing strong price action despite the broader market’s hesitation. These moves reflected speculative interest and increased activity within micro-cap trading communities.